Why does India’s wheat export prohibition matter to the rest of the world?

Image credit: BBC

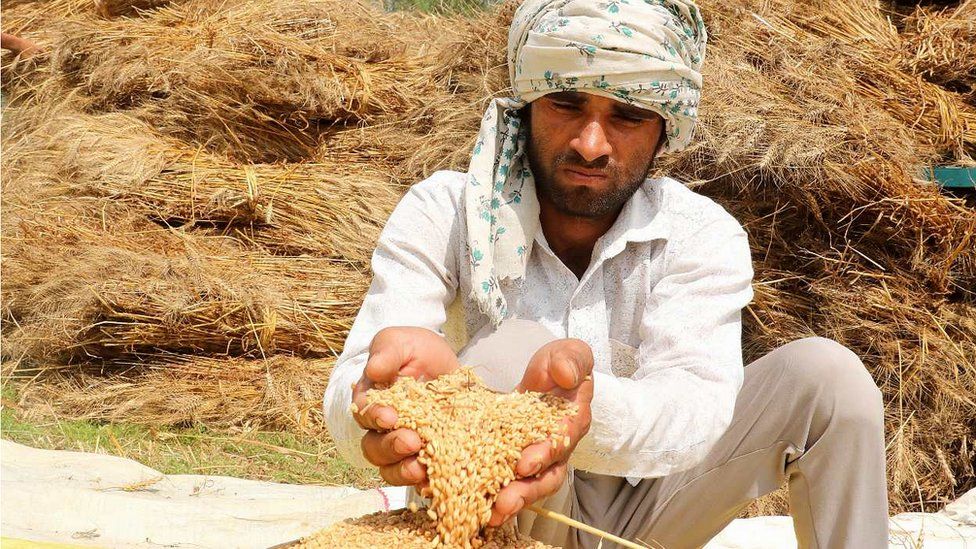

India has defended its decision to ban wheat exports, despite worries that it could worsen the global food supply situation in the aftermath of the Ukraine war.

After the embargo was imposed in May, German Food and Agriculture Minister Cem Ozdemir warned, “If everyone starts imposing export limits that would deepen the issue.”

The embargo was announced on May 13th, after exceptionally warm weather wreaked havoc on the wheat crop, driving up local prices.

Despite the fact that India is not a large wheat exporter, the action caused global markets to get uneasy, with the Chicago benchmark wheat index surging over 6%.

Prices for several of the most common types of wheat increased for several days, peaking on the 17th and 18th of May.

India has the world’s second-largest wheat production, yet its share of global wheat commerce is less than 1%. It keeps a large portion of it to subsidise food for the poor.

However, India was aiming to enhance exports by shipping a record 10 million tonnes of wheat this year, compared to barely two million last year, just before the ban was announced.

It was supplying new markets in Asia and Africa, and even after the prohibition, numerous countries indicated they were in contact with India to continue exports.

Bangladesh, Nepal, and Sri Lanka, as well as the United Arab Emirates, are its primary export markets (UAE).

According to a US government assessment, worldwide wheat production will be at its lowest level in four years in 2022–23, and global wheat inventories will be at their lowest level in six years.

Because of excessive rains in 2021, China, the world’s top producer of wheat to its massive population, announced in March that its winter crop could be the “worst in history.”

The real state of the harvest and whether or not it will be severely harmed are still unknown.

However, if this is the case, China may choose to replenish its stockpiles on global markets, further constraining global supplies and driving up prices.